Sep 9, 2024 |

When it comes to budgeting, planning salary increases often doesn't receive the level of attention and importance it truly deserves.This article focuses on establishing the right approach and assumptions for your budget planning, ensuring you neither underestimate nor overestimate the financial impact. It's less about the mechanics of running salary reviews and more about integrating these increases into your broader financial planning.

Why accurate increase planning matters for your bottom line

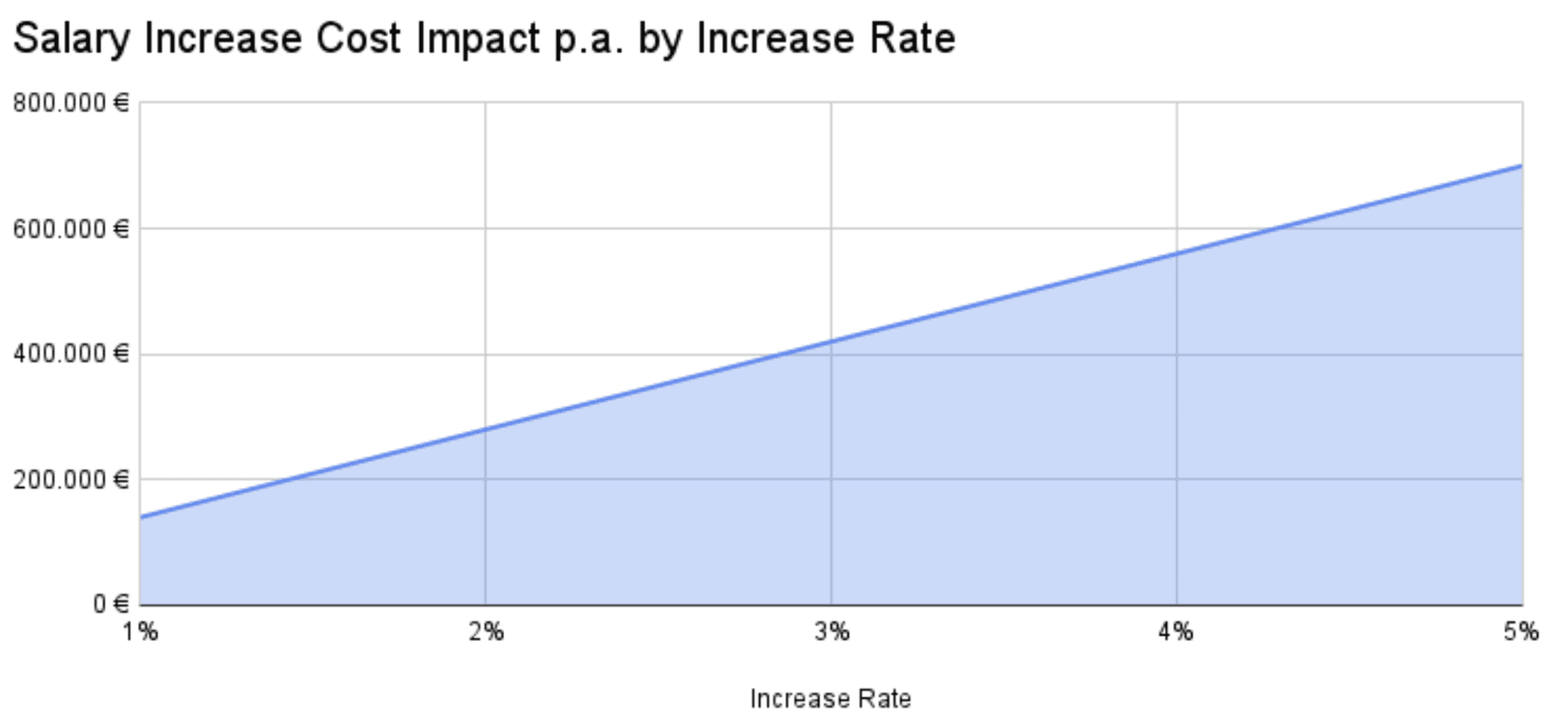

Salary increases are among the most significant—and often underestimated—factors in budgeting. For example, in a company with 200 employees earning an average of €70,000 annually, even a modest 4% salary increase would add €560,000 to the company’s yearly costs. Moreover, budgeting must account for any already realized pay raises and their timing, further complicating the forecast.

Model based on a company with 200 employees earning an average of EUR 70k p.a.

Based on our experience working with various companies, we've seen multiple approaches.

Approaches to Budgeting for salary Increases

Top-Down Approach

Many companies apply a fixed increase rate (e.g. 4%) uniformly across the entire organization. Alternatively, some segment their workforce (e.g., by department, job level, or lowest-paid employees) and apply fixed rates across these groups.

Advantages:

Simplicity in Budgeting: This approach is easy to calculate and implement, making it straightforward to incorporate into the overall budget. It reduces the administrative burden on financial planning teams.

Cost Predictability: Offers a predictable impact on the overall payroll budget, which aids in high-level financial forecasting and controlling, minimizing surprises during the fiscal year.

Disadvantages:

Inflexibility: Lacks the adaptability to respond to specific financial goals or market conditions, making it harder to optimize costs across different areas of the organization.

Potential for Budget Inefficiency: Uniform increases may not reflect actual business needs or employee performance, leading to suboptimal allocation of salary funds, which could strain other budget areas without corresponding performance improvements.

Bottom-Up (Merit-Based) Approach

This approach involves reviewing each employee’s performance and planning increases on a merit basis, allowing for more personalized adjustments.

Advantages:

Targeted Budget Allocation: Enables precise allocation of salary increases based on performance and contribution, optimizing the return on investment in payroll expenditures.

Alignment with Financial Goals: Allows for increases that can be closely tied to individual or departmental performance metrics, ensuring that salary expenditures are directly linked to achieving business objectives.

Disadvantages:

Administrative Complexity: Requires significant time and resources to assess individual performances accurately, adding complexity to the budgeting process and increasing the risk of errors in financial planning.

Budget Variability: Creates unpredictability in the overall salary budget, complicating financial control and potentially leading to unforeseen budget overruns if not carefully managed.

Market-Based Approach

This approach involves adjusting salaries based on external market data, using comprehensive benchmarking to ensure that compensation remains competitive. Using tools such as Figures or Ravio can be helpful in providing these real-time market benchmarks.

Advantages:

Informed Financial Planning: Relies on up-to-date market data, allowing for more accurate and justified budgeting decisions that align with industry standards, reducing the risk of overpaying or underpaying staff.

Competitive Positioning: Ensures that the organization's compensation strategy is aligned with market conditions, helping to control costs while remaining competitive in talent acquisition and retention.

Disadvantages:

Volatility in Budgeting: Market rates can fluctuate significantly, leading to potential challenges in maintaining budget stability and forecasting future salary costs accurately.

Resource Intensive: Requires ongoing investment in market data tools and analysis, adding to the administrative and financial burden of managing the compensation budget.

Need for frequent adjustments: omplicates long-term budget planning and control.

Common Pitfalls on Salary Increase Planning

When planning for salary increases, consider the following factors to ensure a well-rounded approach:

Historic Increases: Analyze past salary trends within your organization to identify patterns and set realistic expectations for future increases.

Inflation Adjustments: With rising living costs, consider whether to include inflation-based increases in your budgeting to maintain your employees' purchasing power.

New Starters: Factor in the potential need for salary adjustments for recent hires, ensuring their salary remains competitive and aligned with market standards.

So what now?

There are three questions that you should ask yourself to identify how to prepare your salary planning:

How dynamic is your next year going to be?

Do you expect strong growth and it will be hard to even know how many people will work for you?

Rather choose a top down approach, providing you a margin of error and saving you time.

How closely do you have to watch your cost?

Are you trying to move towards profitability? Or do you even want to cut costs?

The bottom-up approach will allow you to get a very detailed overview of your true costs.

Have you encountered complaints about fair compensation in the past? Did employees even mention intransparency?

It might be time to do a market based benchmark and plan on common and accurate industry salaries.

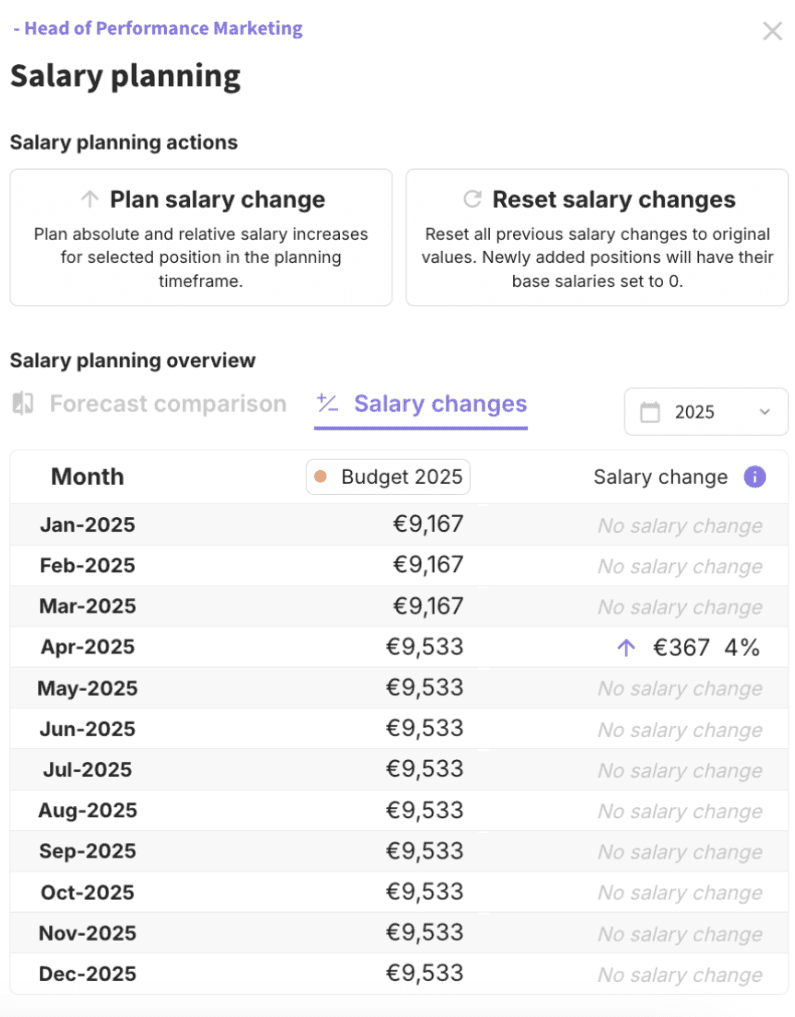

Flexible Approaches with Cartha

Cartha allows for flexibility in planning, supporting both top-down and bottom-up approaches to salary increases. Whether you prefer a straightforward, uniform increase or a more nuanced, merit-based adjustment, Cartha provides the tools to implement your chosen strategy effectively. Furthermore, Cartha makes historic increases transparent, avoiding tedious data collection and consolidation.