Jan 31, 2024 |

In today’s fast-paced business world, financial forecasting stands as a vital tool for companies striving to navigate the turbulent seas of market fluctuations and economic uncertainties. However, many businesses find themselves grappling with a significant challenge in this area: accurately predicting and managing people costs, often their largest expense. This struggle is not just about numbers; it’s about understanding the dynamics of a company’s most valuable asset — its workforce.

Let’s delve into some of the main causes of these struggles.

The Challenges in Forecasting People Costs

Insufficient Use of Existing Data

In many organizations, employee-related data is scattered across various systems, making it a Herculean task to consolidate and update this information. This fragmentation leads to a lack of comprehensive understanding of the existing workforce, which is crucial for future planning. The data is there, but it’s like having pieces of a puzzle spread across different rooms.

A common scenario: Frustration is ever-increasing between stakeholders due to previous collaboration issues. Finance is trying to combat poor data quality with growing data collection requirements. This leads to more difficult tasks for stakeholders such as People Operations, Talent Acquistion or Hiring Managers, who only have marginal touchpoints with headcount planning. As a result, they quickly feel overwhelmed with the growing level of sophistication while missing to see the value of proper data contribution.

Losing Sight of the Big Picture

Often, companies get bogged down in the minutiae, focusing on overly granular details at the expense of understanding the broader trends. This approach is akin to missing the forest for the trees. By not prioritizing the largest levers of people costs, companies miss out on valuable insights that could drive more effective decision-making.

Ask yourself the following questions: Do you really want to track every granular workplace cost on employee level? Is it absolutely necessary to consider every single benefit on position detail? The answer is likely no if you are failing to easily answer the simple “Am I over or under budget?” question.

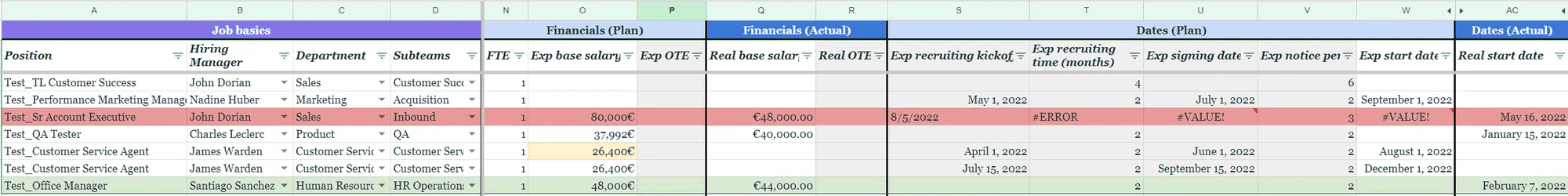

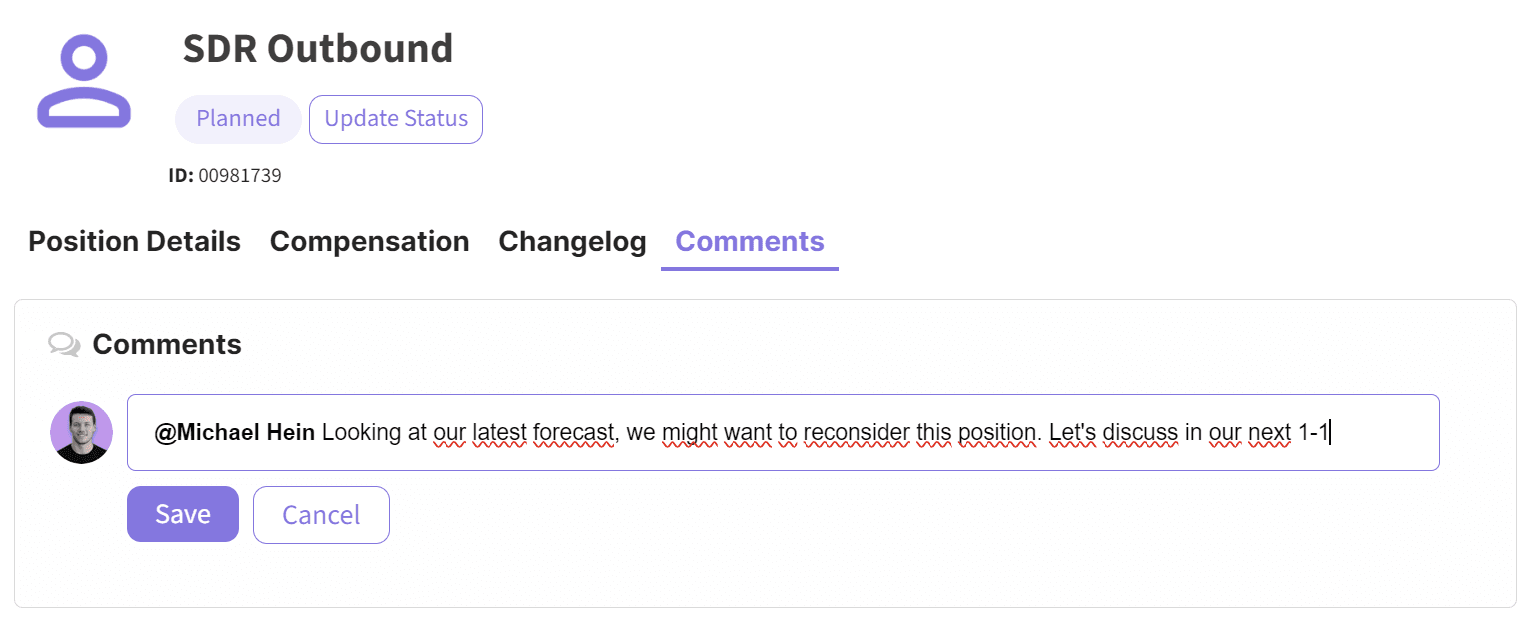

Difficult Collaboration

The widespread reliance on spreadsheets for managing financial forecasts leads to another significant hurdle — collaboration. When forecasting processes are based on complex, hard-to-navigate spreadsheets, coupled with unclear instructions, it impedes effective communication and teamwork, essential for accurate forecasting.

Commonly, organizations struggle with the well-known GIGO problem — Garbage In, Garbage Out. Everyone who has worked with colorful Excel sheets containing incomplete critical fields knows the drill. The root cause very often lies at the beginning of the headcount planning process — properly establishing collaboration with the involved stakeholders. If you fail to do so, you end up spending more and more time down the process, thanks to the cascading nature of data issues comparable to the bullwhip-effect.

How to improve your headcount planning

Addressing these challenges requires a methodical approach, where improvements are introduced in manageable steps or milestones. Keep iteration cycles short and try to make sure you generate the learnings you need before you move on to the next phase.

High-Level Cost Item Measurement

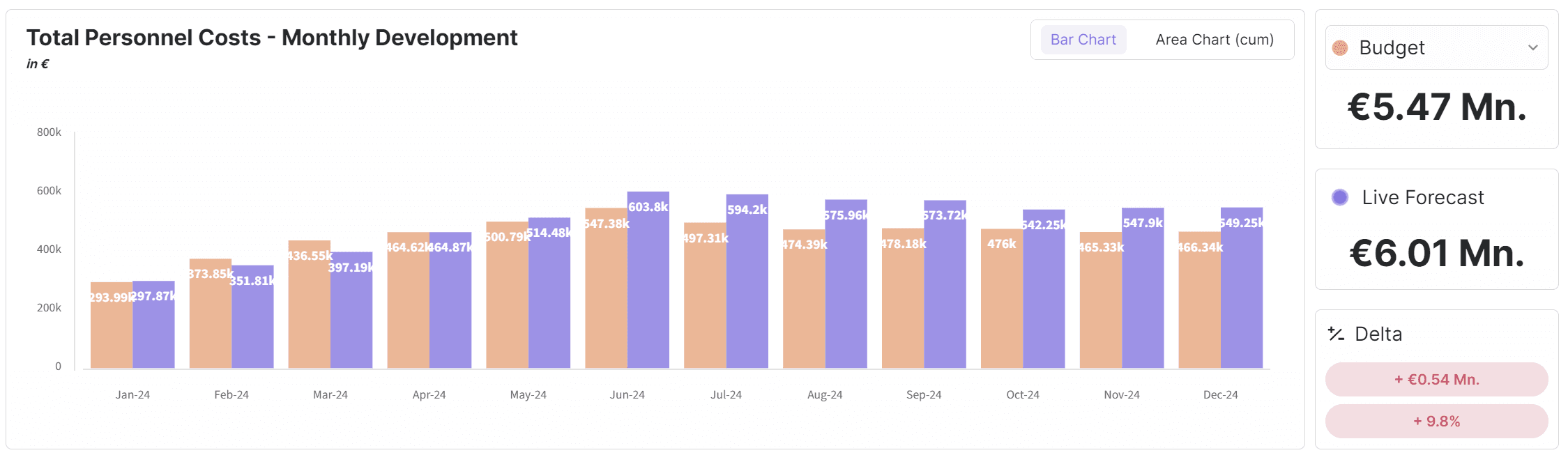

The first milestone is gaining the ability to easily measure deviations from your budget. This step is about getting a clear, high-level view of where the numbers stand versus the plan.

You would be surprised how many companies already fail at this step because their data basis is a mess. Too much time goes into manual, repetitive tasks, which are error-prone and need to be repeated once only slight changes in the assumptions occur — leading to more errors. Defining strict data schemas and field mappings will ensure that you have high certainty when interpreting your data, and to avoid starting cleaning input when you think you are ready for data analysis.

Analyzing Deviation Drivers

Once you have a handle on the high-level numbers, the next step is to dive deeper into understanding why these deviations occur. This analysis is crucial for identifying underlying trends and patterns that can inform future forecasts.

The main drivers can be grouped into two buckets

Headcount driven deviations: Think of this as deviations caused by overhiring, or a change of quantity. Unplanned positions are contributing to excess payments

Compensation driven deviations: This equals unplanned salary increases and everything that’s related to the price dimension. If you see a devication here, dive deeper into significant cost items like base salary, variable compensation, and social charges. If you cannot explain the differences from those, you might also want to look into benefits and alternative, one-off compensations.

Actionable Responses to Deviations

The final step is to use the insights gained from the analysis to take concrete actions. This could involve adjusting budgets, reevaluating compensation strategies, or introducing new policies. As the forecasting process matures, companies can increase the granularity of their analysis, considering additional factors like bonuses and benefits.

Conclusion

In conclusion, the journey to mastering people cost forecasting is not an overnight endeavor. It requires a strategic approach, where companies incrementally build their capabilities, starting from a high-level view and progressively delving into more detailed analyses. By addressing the common pitfalls and adopting a structured milestone-based approach, businesses can transform their financial forecasting from a challenging task into a powerful tool for strategic decision-making. Let’s not just forecast numbers; let’s understand and plan for the future of our most valuable asset — our people.