Feb 25, 2024 |

The CFO of a 400 employee, traditional company recently shared one of his biggest pains with us. The budgeting processes of his company takes roughly 4 months - putting their operations almost at freeze. Imagine their daily discussions: Can we move on with a new vendor? No, we’re discussing budgets. Can we sign this candidate? Not yet, our budget is not final. Long budgeting cycles paralyze decision making abilities for businesses.

What’s broken with budgeting

Usually it works the following way: Leaders craft budget scenarios and align on them. If the plan sounds reasonable, they forward the template back to finance. Finance goes into the machine room for days & nights (Excel) and puzzles the dozens of spreadsheets from each leader together. As an outcome, there is a draft P&L, which is then reviewed and triggers a cascade of new discussions.

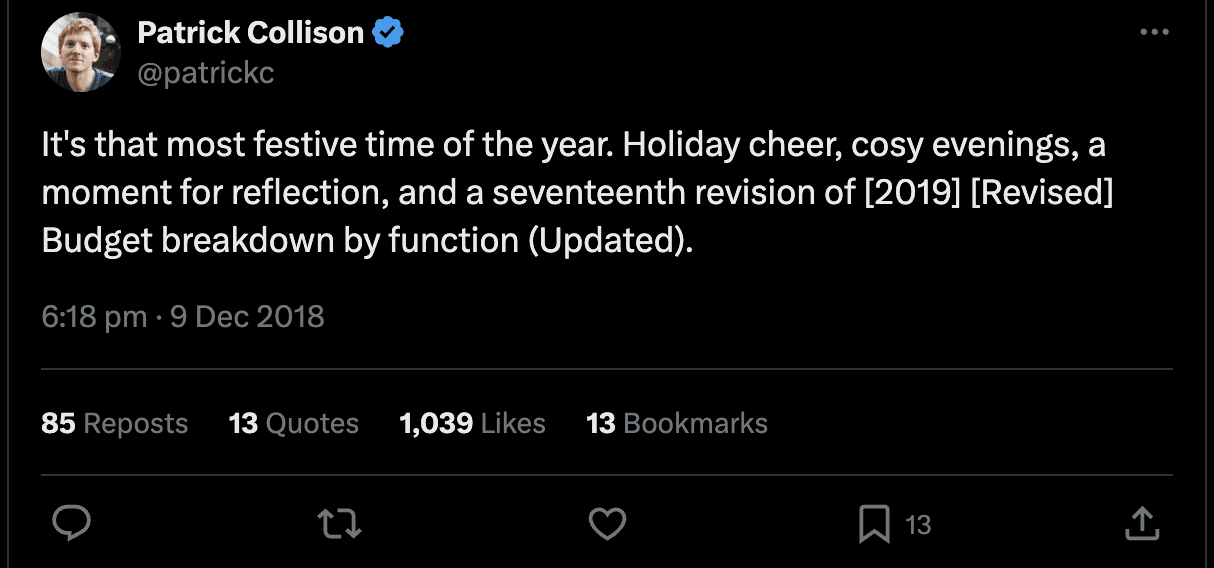

Throughout the months of crafting the budget, things stay dynamic - especially when it comes to workforce. Employees quit and might need to be replaced. Employees demand an increase in compensation or quit. These events contribute to the fact that versions get updated and updated - v1, v2, v17. As soon as the ink is dry (should I say the .xlsx is saved?), things change again.

However, this practice, for all its merits, has a critical flaw—it assumes a static world. In delineating and fixing measurable targets, businesses implicitly expect the ground beneath them to remain unchanged.

Budgets produce financial targets, not executable business plans

The outdated aspect of this tradition lies not in the setting of goals but in the static, line-by-line planning of financials, set in stone for the entire fiscal year. But the nature of businesses is dynamic.

Will your cost budget still be valid in the event of a revenue underachievement? Most likely no.

Will your planned Engineering team lead from last November’s hiring plan still be approved under these circumstances? Most likely not.

Will your cost center structure remain static across the year? Unclear - but the overall Revenue and EBITDA targets most likely yes.

Static plans just illustrate one way of achieving your north star (P&L; rule of 40, EBITDA) - nobody cares about it with more available information.

Why do financial plans not get updated on a constant basis with Actuals and changing variables?

it consumes a lot of time to update each cost item line by line

it costs alignment with stakeholders + dozens of spreadsheets

A New Paradigm to Planning: Real-Time Reforecasting

The solution is not to discard the budget, but to transform it. Let your budget set the course, but embrace the power of real-time reforecasting and collaboration to make planning dynamic. This approach allows businesses to adapt their financial strategies with the agility required in today's fast-paced world.

Here is an example:

CTO needs a senior engineer instead of Jr. Engineer that was listed in the budget plan

He files a new approval request

first, People team approves from a hiring & org design perspective

second, Finance approves that there is budget

After approval, requisition gets directly pushed into the ATS

People has transparency on which positions should be hired

Finance has transparency on cost impact

Leaders have transparency on how they perform against their budget

Instead of several spreadsheets, leaders, Finance & People Team collaborate in one platform with user-level-access rights and a built in approval process.

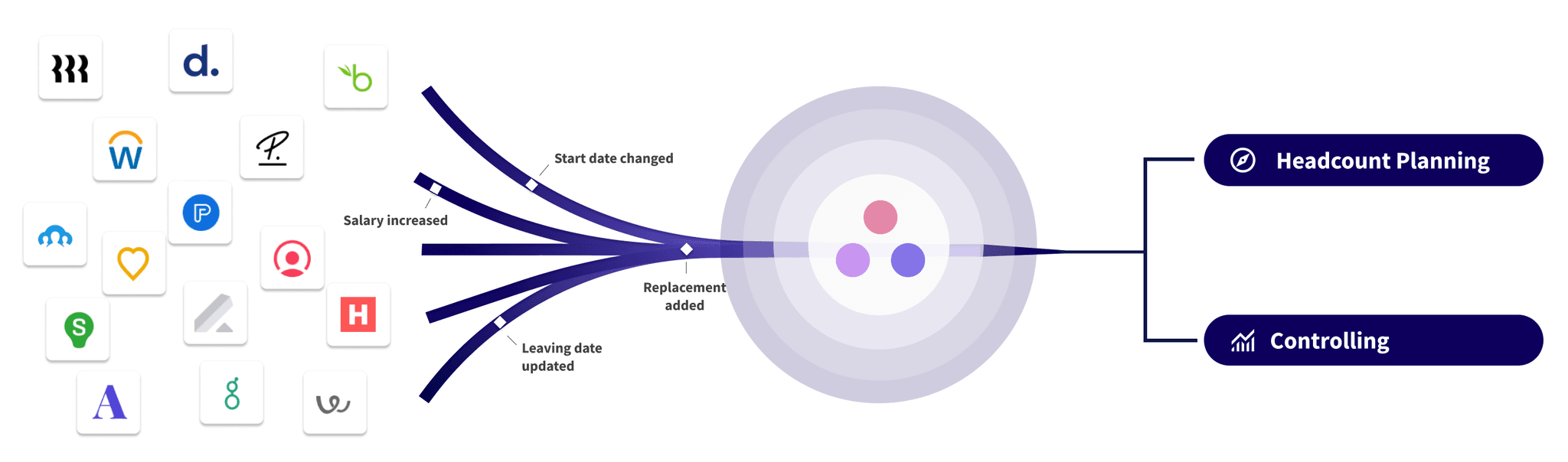

Leveraging Technology for Situational Adaptiveness

The advent of integrated software solutions has demolished the barriers to real-time financial agility. These tools offer seamless updates to financial forecasts, enabling businesses to respond to changes with unprecedented speed. Collaboration on data and access controls further streamlines the planning process, ensuring that every part of the organization is synchronized in real-time.

This technological leap is not merely about efficiency; it's a fundamental shift in how businesses view their finance function. Finance becomes more than a mere custodian of numbers; it transforms into a strategic partner, equipped with real-time insights to guide decision-making at the highest levels.

Finance: From Gatekeeper to Navigator

In embracing real-time business planning, the role of finance evolves. Instead of comparing line item Actuals vs. Budget, it should support leaders in realising their updated plans, while staying within budget.

Let’s reimagine the situation above from the CTO.

Instead of rejecting approval because a Senior Engineer should be hired, they should outline ways for the CTO to make this hire, while maintaining costs.

It moves beyond data collection and processing to become a navigator, interpreting the vast seas of data to chart the course ahead. This partnership between finance and the broader business is not just beneficial; it's essential for survival in an era where adaptability is synonymous with success.

Conclusion: The Inevitable Evolution

The transition from annual planning to real-time business planning is not just a trend; it's an evolutionary step in the maturation of business practices. As we navigate the complexities of the modern business environment, the ability to adapt in real-time is not merely an advantage; it's a necessity.