Oct 9, 2024 |

Budgeting personnel costs with a flat social charge rate is often excused by the idea of having a "buffer" for unforeseen expenses. However, this approach is much like packing a suitcase without actually weighing it. You may think you’ve packed enough, but without knowing the actual weight, you risk either going over the limit or not being fully prepared.

In the same way, relying on an estimated social charge rate can lead to over- or under-budgeting. Wouldn’t it be more effective to plan precisely, then add a clear and well-defined buffer on top? This way, you can avoid the guesswork and ensure that your budget is not just enough, but optimized and controlled. Just like weighing your suitcase ensures you’re ready for the journey, accurate social charge planning guarantees your company’s budget stays on track.

Why Accuracy in Social Charges Is Crucial for Budgeting

Imprecise social charge rates can lead to either underestimating the true cost of employment, which results in budget overruns, or overestimating costs, which limits your flexibility in personnel planning. By improving the accuracy of social charge estimates, you can make more informed decisions, optimize your personnel spend, and reduce unnecessary financial strain.

The Role of Social Charges in Budgeting (in Germany)

Social charges, also known as indirect labor costs, are a crucial component of overall employment costs. They include various mandatory contributions such as:

Contributions to social security systems are capped once an employee’s salary exceeds a certain threshold. For example, for health insurance in Germany, the treshold is €4,987.50 per month. This means that for employees earning above this threshold, the health insurance contributions no longer increase with salary.

However, simply applying a flat rate, like 21.5%, to every employee can hide substantial cost differences across your workforce. Variations arise from high earners, part-time employees, and workers in different regions, all of which trigger unique variations in social charges.

Different Approaches to More Effective Social Charge Planning

To optimize your social charge planning, it's essential to move beyond flat-rate estimations and implement more precise strategies. Here’s a breakdown of various approaches you can adopt to ensure accurate and reliable budgeting:

1. Segment Your Workforce

Why it works: Different employee groups often come with varying social charge obligations. By segmenting your workforce based on salary, region, employment type, or contract structure, you can apply more precise rates, leading to more accurate budget predictions.

By Country: One of the most critical ways to segment your workforce is by country. For instance, France and Germany have markedly different social charge structures.

In Germany, social charges for employers include pension, health, care, and unemployment insurance. Contribution caps, like the Beitragsbemessungsgrenze, limit costs for higher earners.

In France, social security contributions are also mandatory but include a wider range of benefits such as sickness, maternity, and work-related accident insurance. The overall percentage of employer contributions in France tends to be higher than in Germany. However, French caps and schemes may vary based on the sector or specific employee benefits.

Impact: By tailoring your budget to the specific country where employees are based, you reduce over-generalizations and ensure each location’s regulations are respected.

2. Calculate Total Compensation (Including OTE)

Why it works: Total compensation, especially for sales roles or executive positions, often includes variable pay components like bonuses and commissions, commonly known as On-Target Earnings (OTE). These additional earnings are also subject to social charges, though caps may apply in some regions.

Example: If an employee’s OTE includes a €50,000 base salary and a €25,000 commission potential, the social charge calculation should account for the full €75,000. However, in countries like Germany, where contribution caps exist, you might not need to contribute the full amount, depending on the employee's base pay.

Impact: Including OTE in your social charge calculations ensures that your budget reflects the actual cost of employees who have significant performance-based compensation.

3. Position-Based Social Charge Calculation

Why it works: Not all positions within a company are treated equally when it comes to social charges. High earners, part-time workers, freelancers, and employees on temporary contracts may each trigger different obligations. Segmenting by position enables a more nuanced approach to budgeting.

High Earners: For employees with high salaries, social security contributions may hit caps early in the year (e.g., the pension cap in Germany), meaning contributions aren't needed beyond a certain point.

Part-Time Workers: These employees might have reduced or different social charge obligations compared to full-time workers, lowering your total cost.

Freelancers or Contractors: In many regions, freelancers don’t fall under traditional employment laws and aren’t subject to social security contributions, but companies may need to account for VAT or other business-related taxes.

Impact: Tailoring social charge estimates to specific job types and earnings helps refine budget accuracy. For example, your software engineers may cost less in social charges than your executives once contribution ceilings are factored in.

4. Use Software to Automate Social Charge Calculations

Why it works: Managing complex calculations for social charges across different regions, positions, and salary bands can be overwhelming, especially for large or global companies. Software solutions streamline this process, ensuring real-time updates and accuracy.

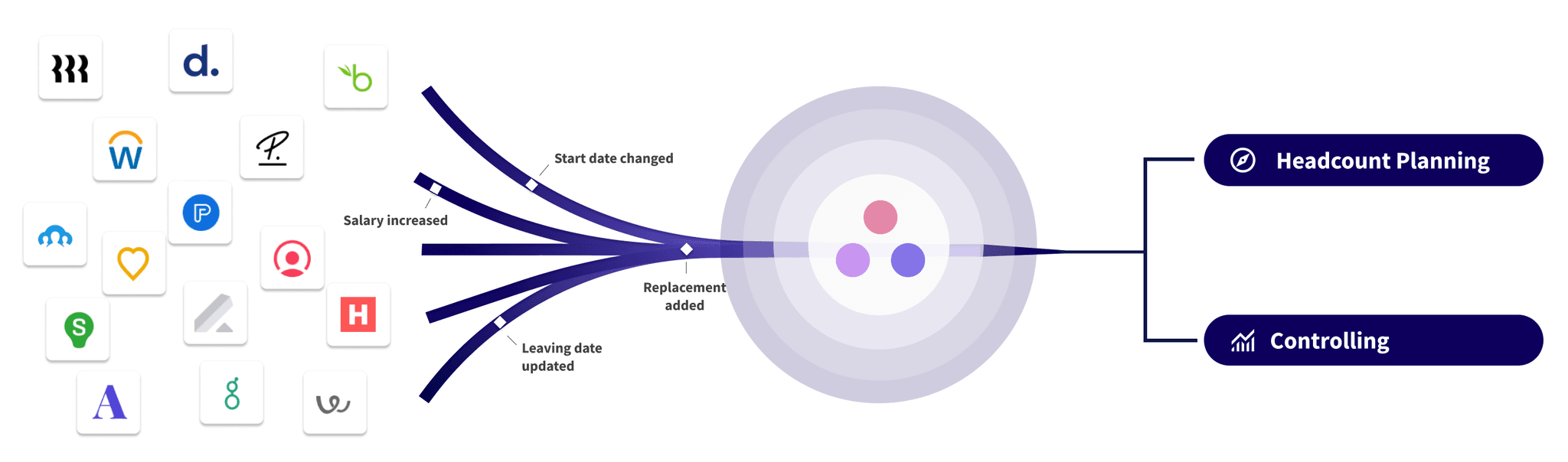

Tools like Cartha can automate the calculation of social charges based on the latest country-specific legislation, contribution caps, and employee data. These tools can handle multi-country operations, different compensation structures, and regulatory changes, making it easier for HR and finance teams to stay compliant.

Impact: By using software, you reduce human error, save time, and stay up to date on regulatory changes in real time. Dynamic tools not only calculate current social charge obligations but also project future costs based on planned hires or organizational growth.

Conclusion

Approaching social charge planning more effectively requires moving beyond flat-rate estimations and adopting strategies that account for the complexities of modern workforces. Whether it’s segmenting employees by country, factoring in total compensation and OTE, implementing position-based charge calculations, or leveraging software for automation, each method contributes to more accurate and reliable budgeting. By employing these strategies, you not only optimize your financial planning but also ensure compliance and cost-effectiveness across your organization.